|

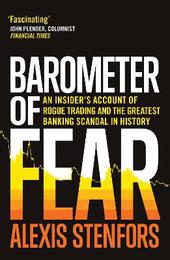

Barometer of Fear: An Insider's Account of Rogue Trading and the Greatest Banking Scandal in History

Paperback / softback

Main Details

| Title |

Barometer of Fear: An Insider's Account of Rogue Trading and the Greatest Banking Scandal in History

|

| Authors and Contributors |

By (author) Alexis Stenfors

|

| Physical Properties |

| Format:Paperback / softback | | Pages:336 | | Dimensions(mm): Height 198,Width 129 |

|

| Category/Genre | Corporate finance

Banking |

|---|

| ISBN/Barcode |

9781783609284

|

| Classifications | Dewey:364.168 |

|---|

| Audience | |

|---|

|

Publishing Details |

| Publisher |

Bloomsbury Publishing PLC

|

| Imprint |

Zed Books Ltd

|

| Publication Date |

15 May 2017 |

| Publication Country |

United Kingdom

|

Description

The LIBOR affair has been described as the 'biggest banking scandal in history', a deception affecting not only banks but also corporations, pension funds and ordinary people. But was this just the tip of the iceberg? Was the scandal the work of a few 'bad apples' or an inevitable result of a financial system rotten to its core? Labelled 'one of the world's most infamous rogue traders' in the wake of a mis-marking scandal, Alexis Stenfors went on to rebuild his life and now guides us through the shadowy world of modern banking, providing an insider's account of the secret practices - including the manipulation of foreign exchange rates - which have allowed banks to profit from systematic deception. Containing remarkable and often shocking insights derived from his own experiences in the dealing room, as well as his spectacular fall from grace at Merrill Lynch, Barometer of Fear draws back the curtain to a realm that for too long has remained hidden from public view.

Author Biography

Alexis Stenfors spent 15 years as a trader at HSBC, Citi, Credit Agricole and Merrill Lynch. In 2009, he found himself at the centre of a 'mispricing' scandal which would eventually result in him being described as one of the 'world's most infamous rogue traders'. He is currently Senior Lecturer in Economics and Finance at Portsmouth Business School.

ReviewsThe most shocking element of Stenfors's new book is that it confirms that the economic crisis, which was effectively created by the banks, did very little to make the banks address their bad habits. * Guardian * [Stenfors] has written a beautifully literate, Jonathan Swift-referencing book about the dark side of the City and in particular Libor, the London interbank offered rate that was once dubbed the "barometer of fear". * The Times * A searingly honest account of the activities of traders in the world's global markets, written in an accessible style by a brilliant, but touchingly human trader who found himself at the very vortex of the great financial crisis. Barometer of Fear offers deep insights in to the workings of the machinery that is the global financial system. * Ann Pettifor, author of The Production of Money and Just Money: How Society Can Break the Despotic Power of Finance * A fascinating insight into the culture of modern banking and the psychology of risk taking on the trading floor. * John Plender, Financial Times columnist * Stenfors uncovers how unregulated finance operates, or more precisely how traders think. He exposes a system out of control, incapable of self-restraint, nourishing rogue behaviour and ready to burst again at any time. * Paul Dembinski, Observatoire de la Finance *

|